Product Overview

Specifications

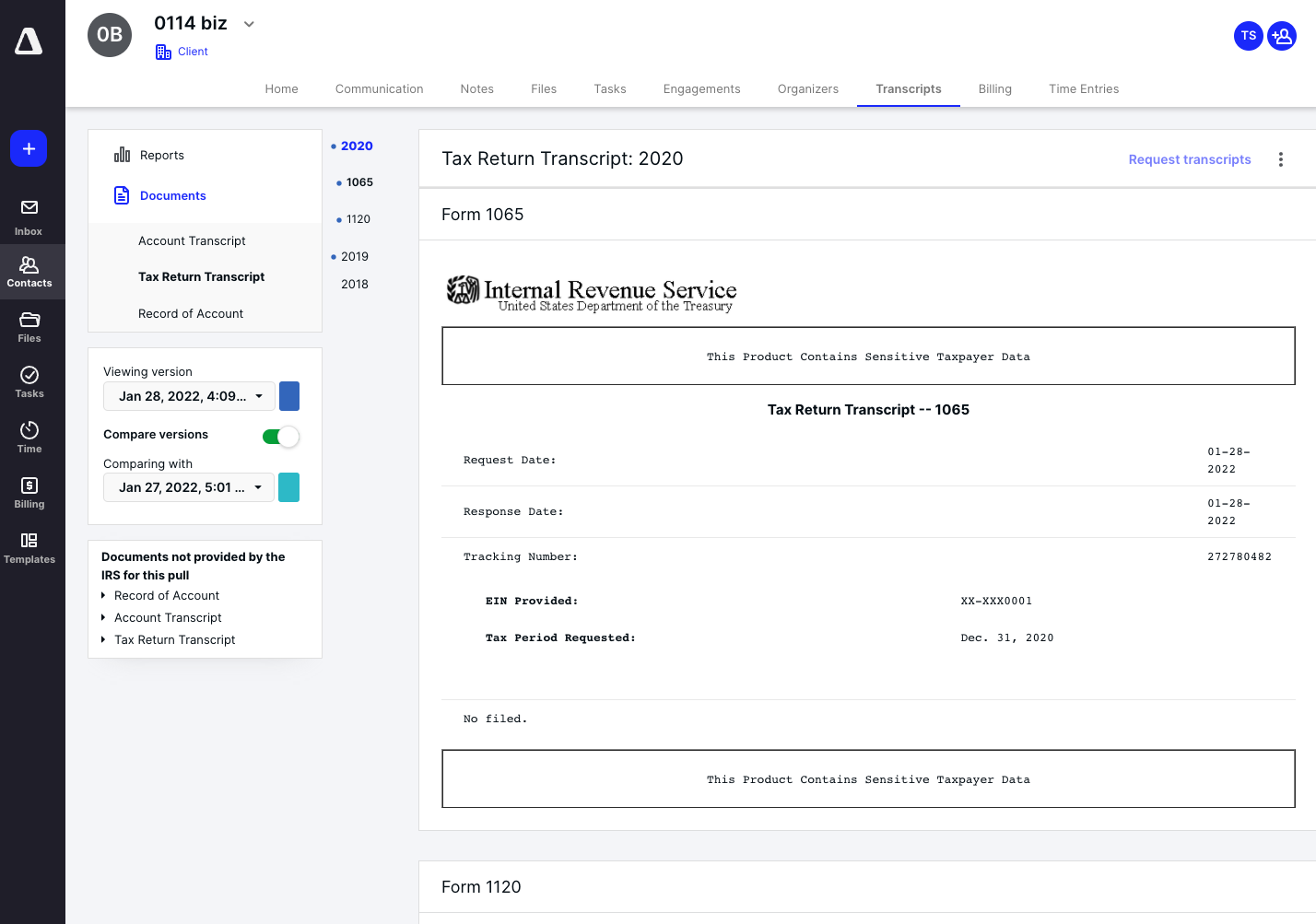

Transcripts

No matter how hard you work to keep

your clients in good standing with the IRS, sometimes they may still get a

notice—a CP14 or a CP2000 or any number of notices. From there, of course, you

have to resolve it and the first step toward doing that? Pulling a client’s IRS

transcript in Canopy. That way, you have the exact same information as the IRS

and can gain insight into the issue, all of which helps you get started

resolving things.

IRS INTEGRATION

Canopy’s partnership with the IRS—via

our approved integration—means that Canopy customers have access to a secure,

one-time login to the IRS system through the Canopy system. It also means you

can easily see the estimated, real-time, from-the-IRS status of your transcript

request. Knowledge is power, especially when you’re dealing with stressed

clients, so we do everything we can to help keep you in the loop.

TRANSCRIPTS RETRIEVAL

Once you’ve connected your IRS account

to Canopy, pulling client transcripts is simple, secure, and efficient (not to

mention directly from the IRS system into Canopy). We’re like the dog that

loves to play fetch, minus the copious drool and dog breath.

TRANSCRIPTS MONITORING TOOL

Maybe a watched pot never boils, but a

monitored transcript puts clients at ease. So Canopy makes it simple to stay on

top of it by scheduling recurring transcript pulls. Better yet, we notify you

if and when something changes. It's the magic of transcripts software.

REPORTING

Canopy offers two ways to display

transcript information: 1) showing the unformatted data from the IRS in its

original format, or 2) pulling the transcript data from the IRS into a

reformatted, easier-to-read, easier-to-digest format. We generally despise the

term “easy-peasy” but if the reporting tool fits…

VERSION COMPARISON

Canopy stores all previous IRS

transcripts you’ve pulled on behalf of clients, making it easy to compare

different transcript versions. We help you spot discrepancies or changes by highlighting

the differences between the compared versions.

Notices

Once you’ve got your client's

transcript in hand (well, digital hand…) and are empowered with information on

what the issue might be, you can finally get to work resolving it. That’s where

our Notices products come in.

CONTENT LIBRARY OF NOTICE TEMPLATES

To help you resolve your client’s

notice, Canopy has a library of 350+ prebuilt Federal and State notice

templates that provide an overview of the notice type as well as walking you

through the recommended steps to resolution. Each template is completely

customizable to match your firm’s processes. From each template, you can also

easily link to any pulled transcripts for the client, make quick notes, and see

associated files. We won’t say that resolving a notice is easy, but Canopy

definitely helps make it easier.

CUSTOM & EDITABLE ENGAGEMENT AND

IRS LETTERS

Canopy has draft engagement letters and

IRS letter responses for the various

notice templates, all tailored to help you respond in the best way to resolve

your client’s IRS issue. Canopy can autofill any information from your client’s

record in the letters. And what’s more, Canopy highlights the areas you need to

complete (or delete, if not relevant to your client). If you’ve purchased Document

and Client Management you can save this to your client’s document folder and

share this with them via their Client Portal.

ADMINISTRATIVE FORMS

Handling a client’s notice often

requires having a tax authorization or power of attorney on file. Canopy will

auto-populate the needed IRS and state administrative forms with client

information that’s saved on your client’s contact record in Canopy. Better yet,

the needed forms are provided within the notice workflow so there’s less time

searching for them and reduced time spent filling them out.

ACTIVE NOTICES LIST

In our pre-built templates from the

task list, Canopy shows you a list of all active notices’ as well as next steps

to help you through the process. Filter, sort, and view the active notices by a

variety of attributes. And, if you’ve also purchased Workflow, then you get

expanded functionality that includes filtering and saved views that you can

view on the web or mobile.

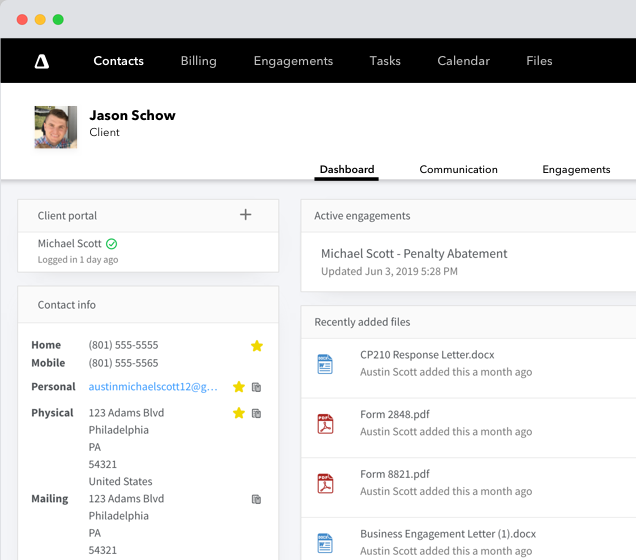

CLIENT REQUESTS

Canopy Notices integrates with our Client Management, if you've purchased it, so you can leverage your notices workflow to send requests to clients. Those requests show up in your customer’s Client Portal making it easy for them to respond—whether they’re on the web or mobile app or browser.

Tax resolution cases

While it may not be the bulk (or

favorite part) of your firm’s business, occasionally everyone has clients that

need assistance resolving an IRS case. Canopy Tax Resolution builds off of the

Client Management module to help make the IRS case resolution process simpler

for your firm. Once you’ve selected the type of case you’re working on for your

client, you simply follow the recommended next steps that Canopy has built out

(or you can build your own custom step-by-step template, you on-brand

overachiever you). Canopy can guide you step-by-step through the whole process,

whatever case type you might have:

Collections: installment agreements,

offers-in-compromise, currently non collectible, liens, levies

Penalties: trust fund recovery,

first-time penalty abatement, reasonable cause penalty abatement

Spousal relief: innocent spouse relief,

separation of liability or injured spouse allocation, equitable relief

Outcome resolution information

We know that you and your clients work

hard to avoid IRS cases, but when one occurs, Canopy can help to guide you

through.

Case service assistant

To get started, Canopy asks a series of

questions about the client and based on the answers, we guide you to

recommendations for how to resolve the issue.

Overview information

Canopy gives you practically everything

you need to know about each case type. Including an overview of the case type,

information on who to call at the IRS, script of talking points, and links to

important or relevant IRS articles.

Recommended resolution steps

When we say that Canopy helps guide you

through the process we mean it and include step-by-step guides. Each template

is completely customizable to match your firm’s processes. And from each

template, you can also easily link to any pulled transcripts for the client,

make quick notes, and see associated files. We don’t want to say that resolving

IRS cases is easy — but it’s definitely easier with Canopy.

Survey style forms that auto populate

Federal and State forms

Your client fills out the Canopy survey

you send them (via their client portal, another perk of having the Canopy

Client Management platform), Canopy then asks you - the accountant - questions.

Then Canopy takes the information from both the client and the accountant and

uses it to auto populate the legal form. All that’s left for you to do, is

review and edit the form, if necessary. Finally, share it with your client in

the client portal for them to eSign (if Document Management is purchased) and

return to you. Then it’s ready to print and file with the IRS.

Client communication tools

Resolving a case requires you to

collect data from your clients, Canopy makes it simple, with our letter

generator, client requests, and financial questionnaire. And because Tax

Resolution works in conjunction with Client Management it’s easy to send to

your client’s portal where they can quickly and easily respond. And

automatically remind them in case they forget to respond.

Letter generator

Canopy offers custom and editable templates

that allow you to send out engagement letters (or really, any letter you want)

to your clients to get your tax resolution cases started. Better yet the

letters automatically fill in any information from your client’s record.

Additionally, it highlights in red text the areas you need to complete or

delete if not relevant to your client. And because Tax Resolution is integrated

with Client Management, it’s easy to share with your client via their Client

Portal. And have them eSign it if you’ve purchased Document Management.

Client requests

Any kind of to do that you request of

your client. Need them to send you documentation? Send a client request. Need

them to eSign a document (requires Document Management license)? Send them a

client request and the process is seamless. You get the idea.

Client financial questionnaire

Have a lot of questions or information

you need to gather from your clients? It’s easy to send a client survey and

have them fill out all that information directly in Canopy. Or you can fill it

out on their behalf during a client meeting. The best part, this information is

used to populate 433 series IRS forms.

Collections outcomes analytics

Last, but not least is a bonus feature

for those pesky collections cases. When you’re trying to figure out what amount

you could negotiate with the IRS on behalf of a client, what potential payment

plans could I put together, etc, the Canopy collections analytics tool

evaluates your client’s financial profile and recommends available courses of

action for resolving their tax debt.

Add Review